20210726

<Gold Market Review>Swap Between Long and Short, Gold is At Stake?

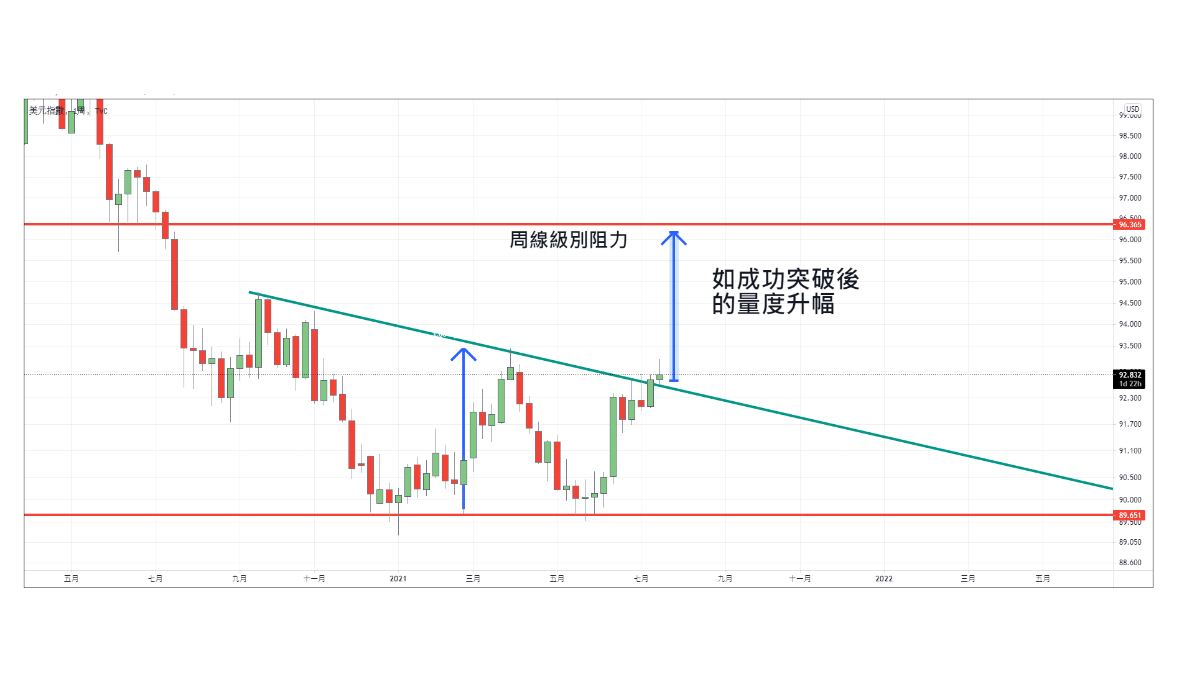

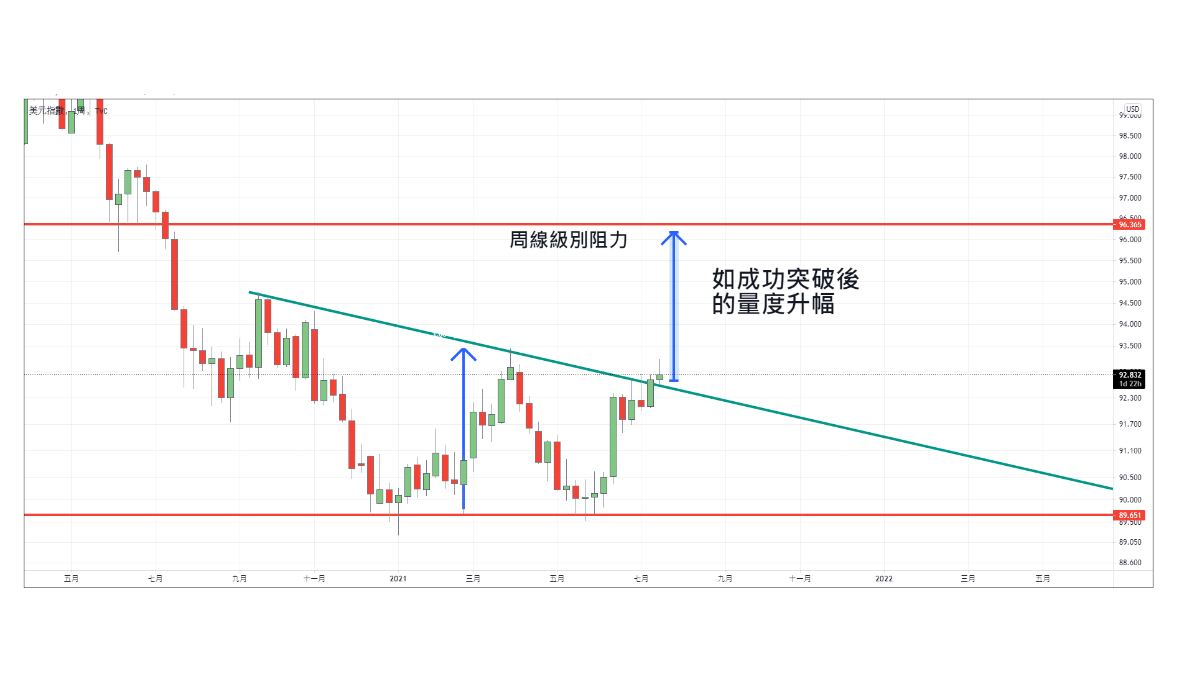

Since the June meeting on interest rates, more than half of Fed officials have predicted that interest rates may rise twice before the end of 2023. The USD has risen sharply due to the news and hit a new high in seven weeks. Figure 1 is a weekly chart of the USD index. It shows that July also continued its upward trend, if it can successfully break through the declining triangle's consolidation range, there is a high chance of measuring the increase to reach the weekly resistance of 96. Predicted that the price of gold will hit a record in the future with a deeper decline.

As mentioned in the previous article, after a wave of decline at the beginning of June, there is definitely a technical need for a rebound in gold. At present, gold has reached its first rebound target of $1,830. This price position is just the resistance of the 0.5 golden ratios of the previous wave of decline. It shows that after the gold reaches the rebound target in Figure 2, significant profit-taking has occurred. Until July 21, there was a more obvious top on the daily chart, and it is even lower than the top in June. I believe it will fall back to $1,763 and test how’s the support of the double bottom again.

Assume that a big black candlestick collapses directly in the future, then I believe that $1,760 will not be held. Once it breaks, there will be close to $100 from the support below. For short-selling investors, the profits are quite lucrative. But when you are bearish, you must also beware of false breakouts. If you break through 1,760 and then quickly pull back and show strong buying, that would be another view.

Everything should be considered in many different ways, the same as an investment. Assuming that a false downward breakthrough and then vigorously reversed its rebound happen on Gold. This proved that there was a large number of buying orders below, and the momentum seems not very weak. Bullish investors can pay attention to the upper US$1,830, which is always a ratio resistance. Once it breaks upward, it will proceed to the next level of 1,873 - 1,900, and the momentum will become strong.

To conclude, gold is controlled by the USD, and if it fails to rise above US$1,830 in one day, it will still maintain as short side dominated.

Hugo Leong Gold Analyst of Hantec Group

Figure 1: weekly chart of the USD index

Extended Reading

<Arts Talk>Will Geography Factors Influence the Style of Wine?

BY Group Branding and Promotion FROM Hantec Group

Hantec Group and Tsi Ya Chai Jointly Organized Painting and Calligraphy Exhibition of Famous Hong Kong Artists in Celebration of the 25th Anniversary of the Establishment of HKSAR

BY Group Branding and Promotion FROM Hantec Group

<Markets Analysis>The Fed is likely to Raise Interest Rates, Pay Attention to 105.80 in USD Exchange Rate

BY Group Branding and Promotion FROM Hantec Group

Unit 4614, 46/F, COSCO Tower, 183 Queen’s Road Central, Hong Kong

(852) 2545 5065 / (852) 2214 4188

11/F, Gold & Silver Comm. Bldg., 12-18 Mercer Street, Sheung Wan, Hong Kong

Room 1214, Block B, Shenzhen International Chamber of Commerce Building, Fuhua 1st Road, Futian District, Shenzhen

A753, 7F, Crystal Galleria, Yuyuan Road, Jing'an District, Shanghai

Hong Kong : (852) 2916 9000

China - Shenzhen : (86) 755-8278 8726

China - Shanghai : (86) 21-5298 3788