20240629

<Gold Market Review>Gold's Volatile Movements: Keep a Close Eye on Key Levels!

The Federal Reserve has remained non-committal regarding rate cuts, exhibiting a slightly hawkish stance, which has dampened the spirits of gold investors. Initially, the optimism brought by decreasing inflation has significantly waned. The market continues to process the Fed's indications that it might not adjust rates. Consequently, the yield on the 10-year U.S. Treasury and the dollar have both surged to their highest levels in two weeks, making it difficult for gold prices to sustain any rebound. Since reaching a record high on May 20, gold has been in a strong downward trend, recently hitting a two-week low of $2,294.

Moreover, May's U.S. new home sales fell more than expected, plunging 11.3% year-over-year, further highlighting the slowdown in economic growth. However, the dollar remained stable despite this data, leaving investors uncertain about the Federal Reserve's next move. This uncertainty is likely to persist for some time.

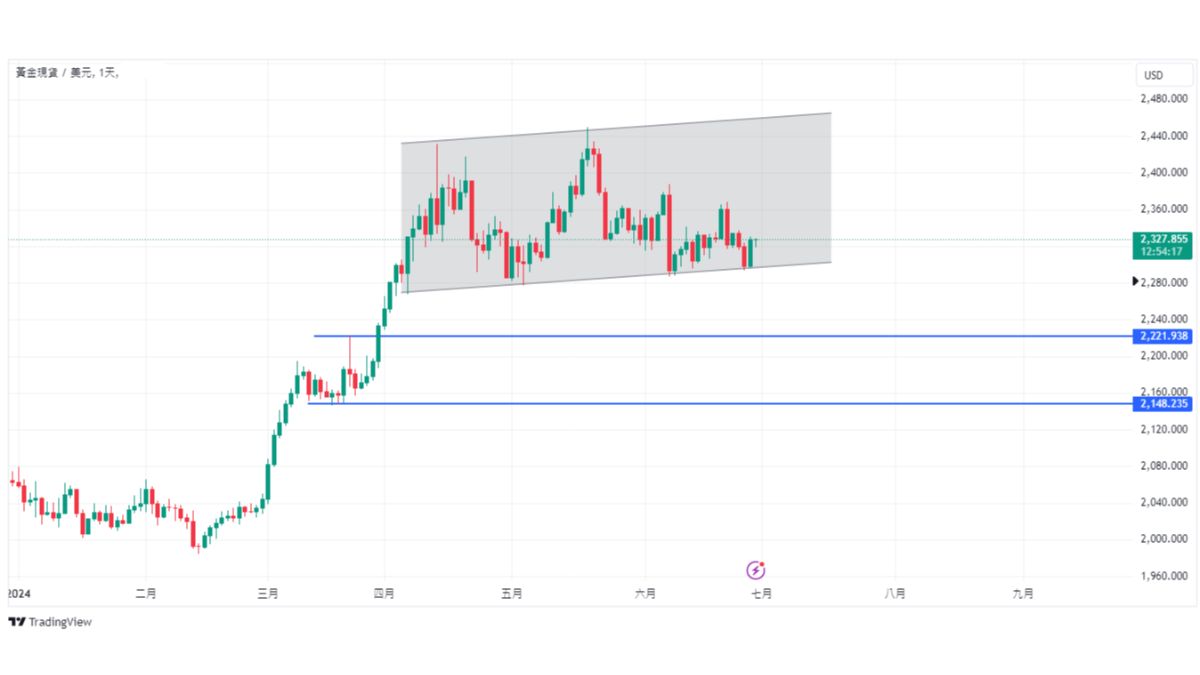

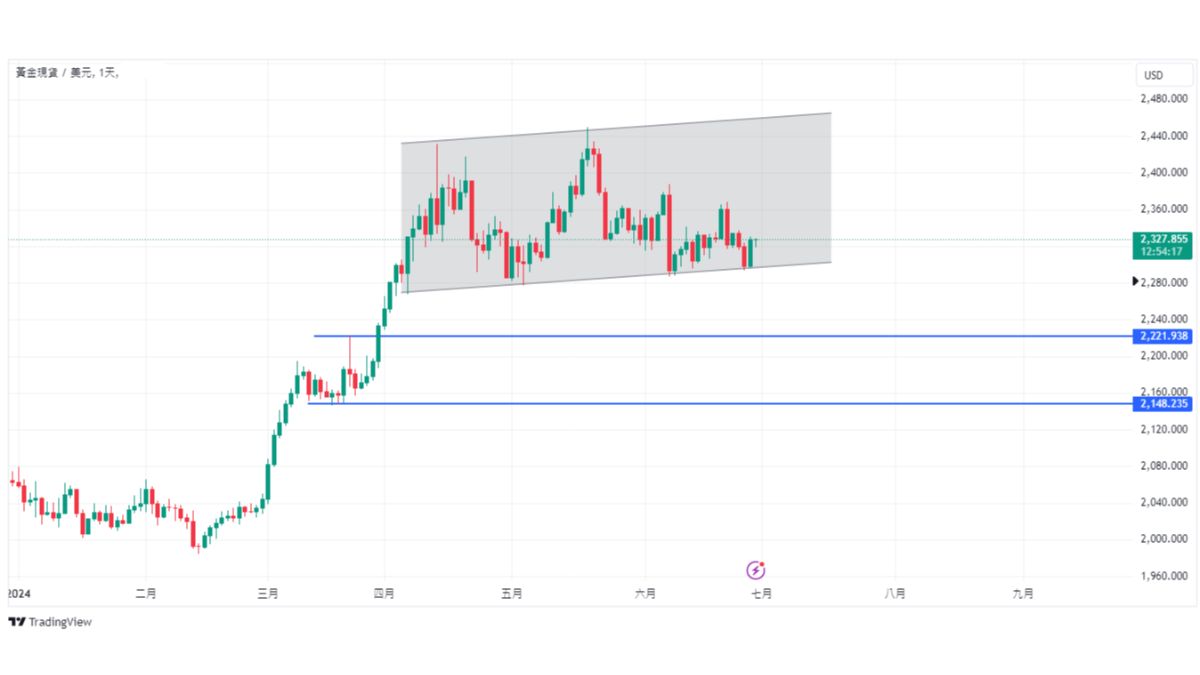

From a technical perspective, the daily chart shows a well-formed upward oscillation in gold prices. However, it is evident that the candlesticks have fallen to the lower boundary of a significant oscillation zone. The MACD indicator is showing a bearish crossover, indicating short-term weakness. The strong bearish candlesticks within the range suggest a clear downward momentum for gold. Without clear supportive economic data or favorable rate outlooks, gold is likely to break below this range, potentially targeting the $2,222 or $2,149 levels.

On the 4-hour chart, gold prices quickly fell from $2,368 to the $2,294 level, almost plummeting from the upper resistance of the recent rebound channel to the lower support line in one swift move. There is a strong likelihood that gold could break below this sideways range. If the price drops below the current range established since April, we could see an accelerated decline, especially since there are no significant support levels below $2,280. The upcoming non-farm payroll data on July 5 might provide clearer direction for the precious metals market. However, if gold quickly rebounds upwards after breaching the range, investors should be flexible and not cling stubbornly to a bearish outlook. Overall, the short-term trend carries significant downward risk, and investors should carefully monitor crucial price levels and potential breakouts.

Hugo Leong

Gold Analyst of Hantec Group

Daily Chart

Extended Reading

Hantec Travel - The 7th Stop: Vanuatu

BY Group Branding and Promotion FROM Hantec Group

Congratulations to Dr. Gordon Tsui, The Former Chairman of Hantec Group for Being Awarded the Bronze Bauhinia Star

BY Group Branding and Promotion FROM Hantec Group

<Arts Talk>The Etiquette of Wine

BY Group Branding and Promotion FROM Hantec Group

1276, 1st Floor, Govant Building, Kumul Highway, Port Vila, Republic of Vanuatu

(852) 2214 4183

No. 24, lane 102, An-He Rd. Sec. 1, Taipei, Taiwan

(886) 02-2755 1681